Intuit Payroll Login

Intuit is a worldwide innovation stage that helps the clients and networks they serve defeat their most significant monetary challenges. They are fixated on their clients.

They listen constantly to clients so they can comprehend both their fantasies and the difficulties they face and afterward will work utilizing innovation to take care of their most significant issues.

About Intuit Payroll

- All throughout the planet individuals battle to get by. Financial freedom is as yet not accessible to all.

- Environmental change is oversized affecting troubled networks.

- At Intuit, they’re focused on utilizing our special situation to discover approaches to control thriving.

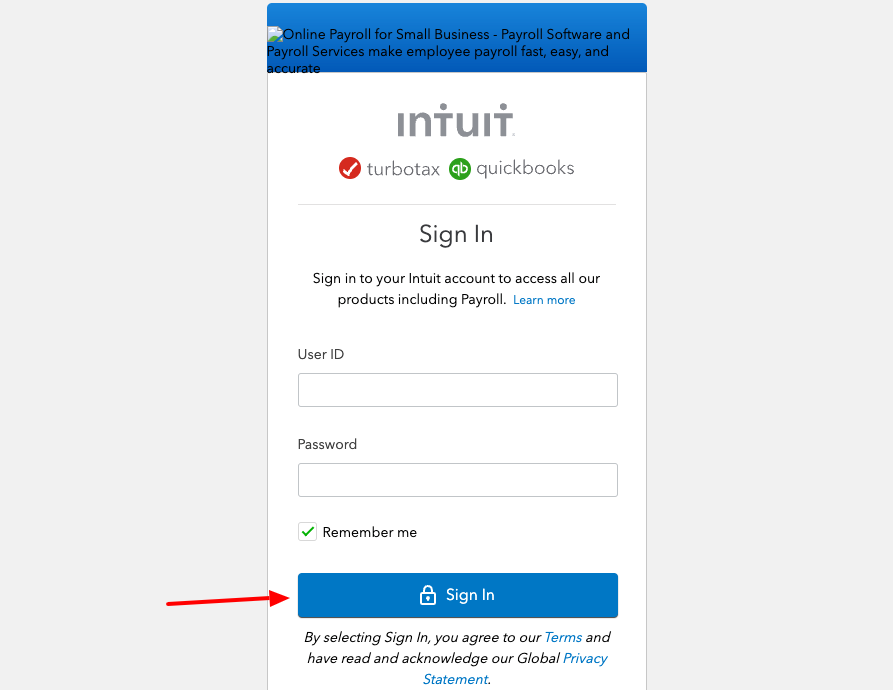

Intuit Payroll Login Process Online

- To log in open the page iop.intuit.com

- You will be forwarded to the next screen to provide your user ID, password hit on the ‘Sign in’ button.

- You can also log in as an accountant.

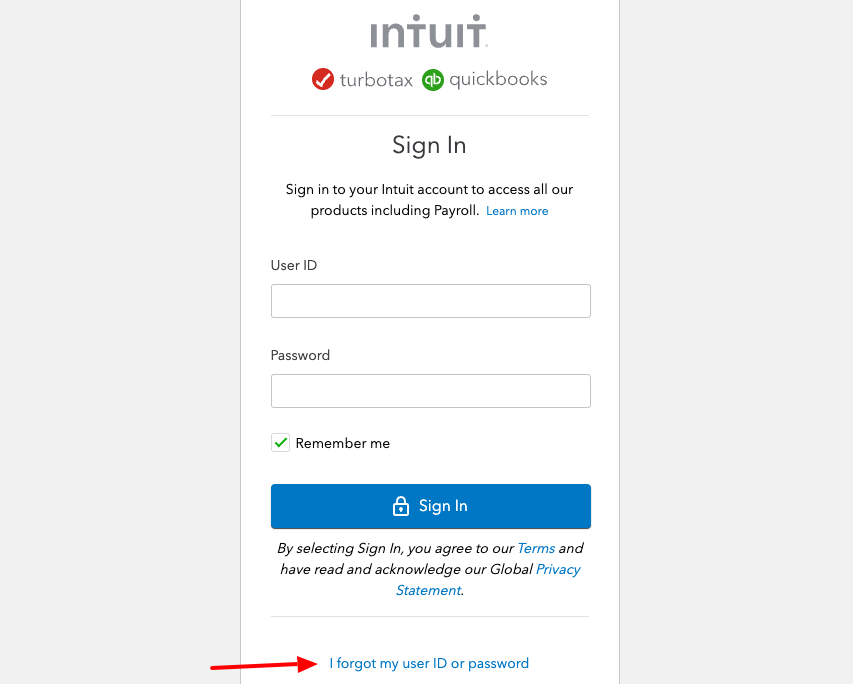

How to Reset Intuit Payroll Login Initials

- To retrieve the login initials open the page www.intuit.com

- After the page appears on the login homepage hit on the ‘I forgot my user ID or password?’ button.

- On the next screen provide your phone number, email, or user ID hit on the ‘Continue’ button.

Intuit Payroll Faqs(Frequently Asked Questions)

- How does Intuit payroll work?

Intuit payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes, and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing, and paying federal and state payroll taxes.

- What are third-party liabilities?

In addition to upholding taxes, employers may also withhold the worker’s share of payments for insurance premiums, retirement plan investments, and other benefits.

- When do I need to file W-2s and 1099s

W-2 and 1099 forms are issued for different reasons. A W-2 is issued to an employee to report gross wages earned, tax withholdings, and other withholdings from gross pay.

Also Read:

Access your GettingOut Online Account at www.gettingout.com

How to Login your Avon Sales Representative Account Online at www.avon.com

How to Access Frontier Online Account at frontier.com

Myths of Professional Tax Preparation

- Online Expense Arrangement Is Dreary: You work in similar kinds of occupations again and again. This couldn’t possibly be more off-base. TurboTax Live serves the U.S. furthermore, Canadian residents across North America, and those living abroad, who have a wide range of various expense circumstances and difficulties. Conventional assessment experts who work locally disconnected will primarily draw customers from their city or state.

- Expense Prep Is Excessively Intricate: There are piles of rules and guidelines: Interesting how this fantasy is something contrary to the first! There is a great deal to dominate, which is the reason TurboTax Live searches for charge experts who have some insight added to their repertoire. In any case, Intuit improves on these guidelines by giving documentation.

- Expense Prep Is Just Occasional: January to April is unquestionably the bustling season for charge planning. Numerous individuals discover the irregularity an or more since it permits them to bring in additional cash with low maintenance or periodic position and can help let loose different seasons for various work or individual pursuits.

- There Are Not Many Freedoms to Develop Your Profession or Challenge Yourself: They’ve quite recently referenced a couple of development openings at Intuit. A significant number of our Tax Associates who start without accreditations proceed to become Enrolled Agents, with their certification expenses paid through their Intuit EA Credential Assistance Program.

- Online Expense Prep Is Restricted to Singular Returns of Under $100K: This is certainly false at TurboTax Live. We work with individuals at all pay levels, including people, families, financial backers, senior chiefs, and individuals who are independently employed.

- Duty Prep Doesn’t Add to The Public Great: Tax prep assumes a basic part in assisting individuals with satisfying their assessment commitments and gives them certainty that they are consistent, pay just what is expected, or potentially get the most extreme discount they deserve. On the individual level, our specialists say they get incredible fulfillment from assisting clients.

- There’s Very Little Accentuation On Variety in The Expense Prep Industry: At Intuit, we’re focused on doing their part to make an assorted, fair, and comprehensive association and to give administration inside their industry. We industriously and consistently measure and screen our advancement to ensure they keep fixed on drawing in, holding, and building up an assorted labor force.

- Online Expense Prep Isn’t Lofty Work: They don’t accept that the duty specialists or clients who return to us quite a long time after year feels along these lines. Their cooperation with clients is more social and engaging than conditional. Our objective isn’t just to respond to their inquiries yet, in addition, to give certainty and true serenity by showing them their duty circumstance.

Intuit Customer Information

To get more details to call on 570 1452 65.

Reference Link